DALLAS, May 2, 2016 –

Agreement restructures more than $2.4 billion of debt

Plan provides for the payment of all allowed vendor claims in full;

Business operations will continue as usual

Dex Media, Inc. (OTC PINK: DXMM), one of the largest national providers of social, local and mobile marketing solutions to local businesses, today announced that it has entered into a Restructuring Support Agreement (the “Agreement”) with creditors holding 66% of its senior secured credit facilities and over 65% of its senior subordinated notes. The Agreement, which is the result of a collaborative effort among the Company’s Board of Directors, management, and major creditor groups, provides for a significant reduction of the Company’s current $2.42 billion in debt and simplifies its future capital structure.

Under the Agreement, the Company and its creditors will seek to implement the restructuring through a prepackaged plan of reorganization (the “Plan”). Dex Media today commenced the solicitation of votes for the Plan among its senior secured lenders and senior subordinated noteholders. The Plan and related materials are accessible at http://dm.epiq11.com/DexMedia. The Company expects to commence voluntary chapter 11 bankruptcy cases in the United States Bankruptcy Court for the District of Delaware to implement the Plan once the solicitation process is complete and the Company receives votes sufficient to confirm the Plan. The Company intends to complete its restructuring during the third quarter of 2016.

“We are very pleased to have reached this important milestone, which will significantly deleverage our balance sheet, simplify our capital structure and unlock even more liquidity to implement our strategic growth plan,” said Joe Walsh, Dex Media President and CEO. “The Dex Media Board of Directors, management team and I would like to thank our lenders for their continued support and our advisors for their assistance in helping us ensure that Dex Media can fulfill its potential.”

Mr. Walsh continued: “Our cash and liquidity positions remain strong, and we continue to generate positive cash flow, which will be more than sufficient to fund ongoing operations. We do not anticipate any impact on our day-to-day business, customer and vendor relationships, or employees. We will continue to advance our strategic initiatives to enhance revenue, reshape client offerings, and streamline our operations.”

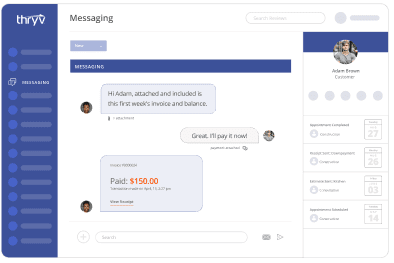

Dex Media is making significant progress in executing its growth strategy. The Company has recently developed and introduced new products and services to help local businesses reach consumers in the channels consumers use to search for businesses. The Company recently launched DexHub and DexLnk, which offer a variety of digital customer engagement tools that enable local businesses to build strong relationships with customers. Dex Media also offers a variety of other digital products in addition to its popular online and print directories.

A key component of the Plan provides for the payment of all allowed vendor claims in full. Additionally, the Company expects that Dex Media employees also will continue to receive all salary and benefits in the ordinary course throughout this process. Dex Media will update the market on developments as appropriate.

Additional material terms of the Plan include:

- Dex Media’s senior secured lenders will exchange their current $2.12 billion of claims for a new $600 million new first-lien term loan; 100% of the equity of the reorganized Dex Media, subject to potential dilution from a management incentive plan; and a cash distribution upon emergence from bankruptcy.

- The Company’s unsecured noteholders will receive a $5 million cash payment and warrants to purchase up to 10% of the post-reorganized equity.

- All allowed trade vendor claims will be paid in full.

Dex Media’s legal advisor in connection with the restructuring is Kirkland & Ellis LLP. Alvarez & Marsal North America, LLC serves as its restructuring advisor, and Andrew Hede from Alvarez & Marsal serves as Chief Restructuring Officer. Moelis & Company LLC is the Company’s investment banker for the restructuring. The steering committee of the ad hoc group of Dex Media’s senior secured lenders are represented by Milbank, Tweed, Hadley & McCloy LLP as legal advisor and Houlihan Lokey as financial advisor in connection with the restructuring. JPMorgan Chase Bank, N.A., as agent under certain of the senior secured credit agreements, is represented by Simpson Thacher & Bartlett LLP as legal advisor to the agent.

The Agreement, Plan, and related materials are available at http://dm.epiq11.com/DexMedia.

About Dex Media

Dex Media (OTC PINK: DXMM) is a full-service media company offering integrated marketing solutions that deliver measurable results. As the marketing department for hundreds of thousands of local businesses across the U.S., Dex Media helps them win, keep and grow their customer base. The company’s widely used consumer services include the DexKnows.com® and Superpages.com® search portals and applications as well as local print directories. For more information about the company, please visit www.DexMedia.com.

Forward-Looking Statements

Some statements included in this release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the federal securities laws. Statements that include the words “may”, “will”, “could”, “should”, “would”, “believe”, “anticipate”, “forecast”, “estimate”, “expect”, “preliminary”, “intend”, “plan”, “project”, “outlook” and similar statements of a future or forward-looking nature identify forward-looking statements. You should not place undue reliance on these statements, as they are not guarantees of future performance. Forward-looking statements provide current expectations with respect to our financial performance and future events with respect to our business and industry in general. Forward-looking statements are based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, the risks related to the following: (i) our future operating and financial performance; (ii) whether the transactions contemplated by the Agreement will be finalized on the terms contemplated in the Agreement so as to permit access by the Company to funds contemplated in the proposed debtor-in-possession financing; (iii) our ability to retain existing business and obtain and retain new business; (iv) general economic or business conditions affecting the markets we serve; (v) our ability to attract and retain key managers; (vi) increased competition in our markets; and (vii) our ability to obtain future financing due to changes in the lending markets or our financial position. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by such cautionary statements.

If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. These forward-looking statements speak only as of the date hereof and, other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts

Abernathy MacGregor

Chuck Burgess, 212-371-5999

[email protected]

or

Rivian Bell, 213-630-6550

[email protected]