There’s scientific support for the theory that having a large vocabulary helps you become a better thinker. It works like this: Your brain grasps complex concepts and uses the technical terms for them as a kind of memory shorthand. Reading about basic and complex business ideas and memorizing the associated nomenclature helps you develop a broad knowledge base you can use as a foundation for future learning, too. Knowing the lingo will enable you to navigate deep business waters more easily and give you added credibility while doing it. The following terms and acronyms are good to know, so consider adding them to your small business lexicon.

Small Business Terms You Should Know

Accrual accounting – A bookkeeping method that records revenue and expenses as they are incurred, independent of when cash is actually exchanged. Accrual accounting can provide a clearer view of a company’s financial condition

Ad valorem – A customs duty charge determined by the value rather than the weight or quantity of an item (from the Latin for: according to value)

Amortise – The process of depreciating the cost of an asset over a prescribed period of time

B2B – business communication involving other businesses

B2C – business communication involving consumers

B2G – business communication involving government departments or entities

Balance sheet – A time specific snapshot of a company’s assets, liabilities, and equity

Business plan – Typically prepared with a strategic plan, a business plan summarizes a company’s goals together with guidelines on how to achieve them.

Caveat Emptor – From the Latin: “Let the buyer beware.”

Cover note – a temporary insurance certificate that provides immediate insurance until formal coverage is issued

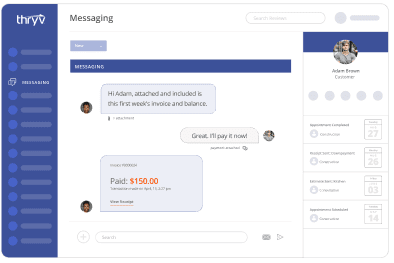

CRM – Strategies used for Customer Relationship Management that typically mine existing or planned data sources.

Debenture – a fixed interest investment secured by a promise to pay the issuer rather than by physical assets or collateral.

EIN – An Employer Identification Number supplied by the IRS (Internal Revenue Service) for tax purposes via form SS-4

Equity financing – Selling ownership interest in a company, often through the sale of common or preferred stock

Fiduciary – An entity or individual responsible for investing and otherwise managing assets owned by others, as in a legal trust

Franchise – A licensing agreement allowing a franchise holder to market goods and services in a prescribed location and within a specific set of guidelines

Lien – A legal claim on goods or property in protection of a debt

P & L (Profit and Loss) – An income statement listing earnings and expenses