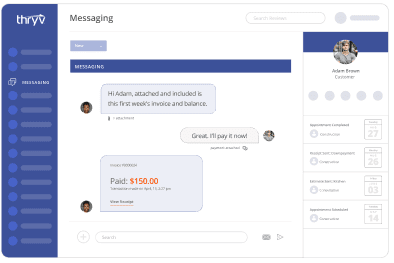

One of the biggest pain points for our local business owner clients is managing the finances that come with owning a small business. Budgeting, bookkeeping and payroll can be confusing and time-consuming. But ensuring you get paid in the first place, and managing that process, can also be a major struggle.

Here are 5 ways to get paid on time, every time.

1. Run a credit check.

If you’re selling big ticket items, it may make sense to run a credit check on customers. Even if they don’t intend to pay by credit card, this can help you better qualify leads and mitigate the risk that they’ll be unable to pay you as much as possible.

Some local businesses also choose to offer their own credit terms to customers (in order to increase their buying potential), in which case a credit check is absolutely essential. Knowing whether someone has a history of not paying their bills can help you protect your business from the same fate.

There are plenty of credit check service providers, each with varying plans based on the size of your business and the volume of credit checks you plan to run.

A few options for checking an individual’s credit:

Pro tip: If you venture into the world of checking credit scores, make sure you avoid conducting unfair credit practices. Learn about the Fair Credit Reporting Act, and ensure you’re on the up and up.

2. Personalize the invoice.

Ever get a restaurant bill or bar tab where a server has added a handwritten note like, “Thank you,” or “See you next time!” and wondered what made them add this extra special note? (Sorry to break it to you, but they may not have been flirting as much as you had hoped.) It’s because some servers know that this extra effort could earn them, on average, an extra 2% on their tip.

Consider adding a quick, handwritten note on each of your invoices. People buy from people they like. Reminding them that someone they like is behind the invoice will make them feel the same warm and fuzzy feelings they felt when they hired you, and they’ll be more compelled to pay you promptly.

3. Make invoices as detailed as possible.

Depending on the type of work you do, the price you charge can vary greatly from service to service and from customer to customer. But for most of our clients who are service providers, a lot goes into what you do. And since you do it every day, it can be tempting to give customers lump-sum estimates and ultimately invoice them based on that original number.

Even if you’re great at estimating the total costs for a job, your customers probably aren’t great at figuring out exactly what goes into the service you’re providing. It’s up to you to break your estimates and your final invoices down as much as possible into individual line items.

Separate out exactly what you’re charging for, including:

- Materials (per unit, if you can)

- Labor (per hour or specific service provided, depending on your industry)

- Consultative or other related fees

- Drive time, if applicable

Being explicit with what you’re billing can do a few things for your business:

- Help customers understand exactly what you did and why you’re charging what you are

- Reduce the number of questions customers may have

- Help your own bookkeeping efforts

- Better protect you against any potential complaints or legal action, should someone try to dispute a charge for some reason

4. Give them more payment options.

If you’re concerned about whether or not you’ll get paid on time at the end of a job, look into additional ways you can split up the bill to accommodate your customers. For example, if you’re invoicing particularly large-ticket items, break up your invoices into smaller amounts, and offer a payment plan. (You can even structure things such that your customers are completely paid up at the end of a job, so you’re not waiting to be paid in full after the fact.) And for the customer, several invoices (each for a smaller amount) will make the monetary commitment feel much more manageable.

5. Don’t be “too nice” to set penalties for late payments.

Many local business owners we talk to say their customers are more like “friends” than customers. What this often translates into is a business owner who may stretch the rules a bit or be more lenient with asking for payment after the sale. While creating relationships and fostering them is good for business, allowing customers to go without paying you isn’t good business at all.

Consider instituting penalties for appointment cancellations or late payments. Then, at the point of sale, make it clear what these are, how they work, and exactly when they go into effect. Work these details into any terms and conditions or relevant service contracts you use to protect your business. Then, reinforce the message verbally.