Many small business owners do not have their companies valued until a sale is in the immediate future, but some believe knowing the value of their business is just as important as running it. A new trend growing amongst start-ups and small business owners is assessing the total value of their businesses, either through online tools, a business broker, or with a certified appraisal.

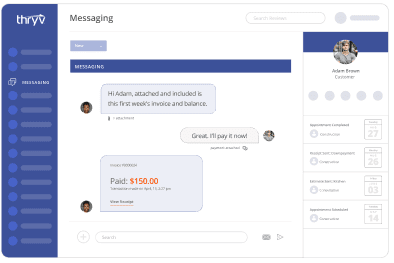

One such business owner, Joe Ritz, found it difficult to purchase his own repair shop when other owners did not know the value of their businesses. “One guy I talked to about selling said the business had to be worth $1 million,” Ritz says, “because that’s what he needed to retire on.” He continues, “Another was like, ‘Well, let me see, my alimony is $4,500 a month…’ It was ridiculous.” Ritz went on to start the Sports and Collector Car Center in Tempe, AZ, but now keeps up with the exact value of his business through a cloud-based computer program. The program works in conjunction with his accounting software to estimate the worth of his business in real-time.

There are three different ways to appraise the true value of your business. One way is known as the asset approach, which values every asset both touchable and immaterial. This is often the way used for quick sales of obsolete businesses. Another method is the market approach, which is more commonplace in valuing still viable businesses. This approach typically bases value on the last 12 months of earnings before interest, taxes, depreciation, and amortization, or Ebitda. The final tactic is the income approach, which looks at the current worth of the expected cash flow. This approach is more common in areas of technology as it examines the full potential a company has to offer.

Another focus for both evaluators and potential buyers is the power of the management team. If evaluators do not have faith in their ability, then your potential value may suffer. Assessors are also concerned with “comps,” or looking at similar companies that have been sold and their earnings. Chris Myers, chief executive of online valuation calculator BodeTree notes, “Everyone likes to think they’re building something that they can sell someday, but unless you focus on it, you don’t know if you really are.”

References:

Cohen, Mark. “Do You Know What Your Business Is Worth? You Should” Small Business Guide, Small Business. Business Day, The New York Times. 1/30/13.