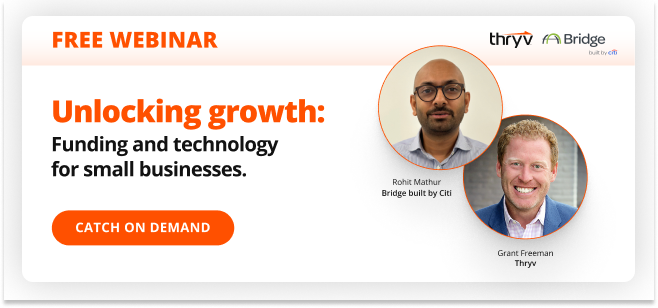

Everyone knows you have to spend money to make money; however, it’s challenging for business owners to secure funds and the system to do so is broken, says Rohit Mathur, CEO of Bridge Built by Citi.

And even if you can get a loan, choosing how to spend it is just as difficult. Thryv President, Grant Freeman suggests technology is the best investment for business growth.

During our latest webinar, Mathur and Freeman solve the struggle of accessing capital and choosing the right technology for growth.

When is the right time to look for a business loan?

The best time to look for a business loan is when you don’t need it, Mathur says. However, a lot of business owners wait until they need it the next day, which makes it hard to get the best financing options.

Whether you’re ahead of the curve or behind the eight ball, forecasting your needs is the first step, Mathur says. Predict where your business will be in six, 12, 18 and 24 months to determine how much funding you need and when you’ll need it.

How do I prepare for the business loan process?

Securing a business loan doesn’t have to be as daunting as it seems. Sure, there’s paperwork and a hoop or two to jump through, but Mathur suggests using this three-step process to get the capital you need in the shortest time possible.

- Understand Your Needs: You’ve already done this to determine when you should look for a loan, but having this information available when you speak to a lender will give them a look into how much you need, why you need it and when you need it.

- Know Your Business: Create a one-page business summary about what you do, a list of suppliers, costs, revenue, who your customers are and employee info. This helps lenders step inside your shoes to understand your business better.

- Collect Financial Documents: Every lender will expect some form of positive financial history. Gather 3-4 financial documents like tax returns, audited statements or unaudited statements.

Should I use my business loan to improve my business’ technology?

Absolutely.

Business loans often go toward a larger space, more company vehicles or special equipment. While you definitely need those things as your business grows, having modern technology that provides an experience customers expect is a non-starter, Freeman says.

Things like paper estimates and invoices, disconnected communication, and cash- and check-only payments can create a loss of revenue and stall business growth.

The right technology is the equivalent of having another employee at a fraction of the cost.

—Grant Freeman, Thryv President

It’s all about being frictionless. Business owners who try to wear every hat and handle everything manually inconvenience themselves and their customers.

Can technology make my business more competitive?

Put your consumer hat on and ask yourself why you choose certain businesses over the competitors. The answer most likely lies within the technology that business uses.

For example, people often choose Domino’s over their local pizza place because Domino’s has perfected an easy, fast and frictionless customer experience. They use technology to digitally communicate with customers, accept payments and create long-term relationships through loyalty and reward programs.

With the proper tools, you can make consumers think you’re a big business because you provide the same experience they’re used to with big box companies.

If you can deliver a superior experience, there’s no reason consumers wouldn’t choose you, Freeman says.

What business technology should I invest in?

Invest in technology that focuses on these experiences: how you create customer relationships, how you communicate with customers online and how customers pay you.

The first is a CRM tool (Customer Relationship Management). Your customer list shouldn’t be a conveyor belt. The most affordable way to grow your business is by retaining and continually serving the customers you already have, Freeman says. There’s massive potential for business growth when you use a CRM to digitally store, organize and leverage customer information to create life-long advocates of your business.

The second is social media. Your legitimacy is questioned when consumers can’t find you on social media. However, creating a profile with basic info isn’t enough. Consumers also use social media to reach your business. You must be set up to communicate and never miss a message, Freeman says. The biggest part of your social presence is effectively communicating your message and promptly responding to inquiries.

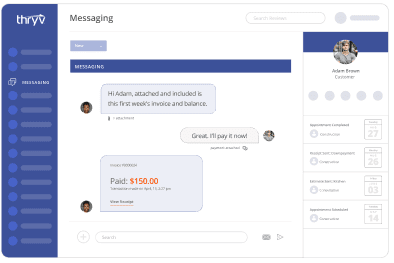

The third is digital payments. Paying digitally is not a nice-to-have anymore, it’s a must-have, Freeman says. Being easy to do business with means streamlining the entire payment process from estimate to invoice to receipt. Show customers how easy it is with technology that houses everything in one place and provides a one-click solution for customers to pay you.

Get Your Growth On

If you plan on growing your business, you’re going to need funding. But before you start ramping up your operations, you need to ensure you have technology that will grow with you and handle a larger workload.

Watch Rohit Mathur’s and Grant Freeman’s webinar to unlock business growth through funding and technology.